Can I Give My Son Money To Buy A House

When buying a home, the biggest upfront expense is likely to be the down payment. Even if future homeowners can reasonably afford monthly mortgage payments, the initial cost of purchasing a home may be too much for them to pay on their own.

"I see gift money becoming more popular, especially among millennials," says Joann Perito, broker and owner of Avenues Unlimited. "Even if they make good money, because of large student loan amounts, it can be difficult for them to save for a down payment."

In 2020, 58% of home buyers came up with their down payment primarily from their own funds. But this cost is often prohibitive, especially for first-time homebuyers who don't have the benefit of funds from the sale of their current residence. That's where a down payment gift comes in — if a close friend or family member wants to chip in and help the prospective homebuyer purchase a home, they can do so. However, there are strict rules and regulations for such a transfer of cash. Here's what you need to know.

Check your eligibility to use gift money for a down payment (Nov 7th, 2021)

How Does Using Gift Money for a Mortgage Down Payment Work?

You can use gifted funds to make a down payment, but your mortgage lender will want to know some details before they allow you to use it. Only two specific groups can give a home buyer money to fund their down payment.

- A friend or family member — as long as they can prove they have a standing relationship with the buyer

- Government agency — as part of a program meant to get first-time buyers into the market

You must confirm the relationship between you and the gift giver

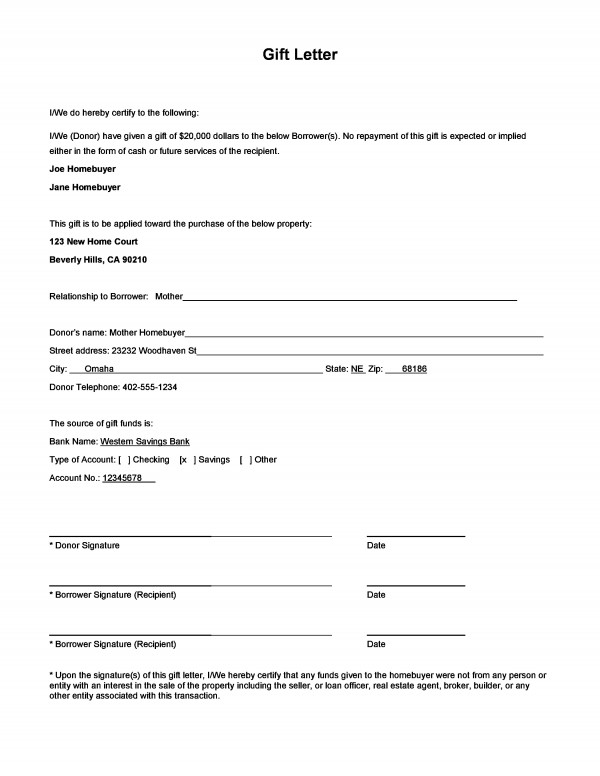

If you plan on getting gift funds from a friend or family member, you'll need a gift letter confirming your relationship to the giver. The letter also must indicate that the money is a gift and that there is no expectation of repayment. Usually, the letter is signed by both interested parties.

Gift Letter Template

The lender may also require further evidence of the gift — for instance, they may ask to see the gift-giver's bank statements to show there are sufficient funds in the donor's account to make the gift. They may also ask for a bank slip from the buyer's account to show the down payment funds have been transferred.

Often, gifts change hands during the application process — this allows time for the money to show up on both the giver and the buyer's bank statements and for the mortgage lender to verify that the cash is from a legitimate source and the pair has an appropriate relationship.

If the gift funds are added to the buyer's bank account after settlement, then documentation will still be required before it can be applied to the purchase. Typically, this will require a receipt of the cashier's check as given to the closing agent.

Can you pay back a mortgage gift?

The answer is no. This is considered mortgage or loan fraud, which is a crime. It can also put your loan qualification at risk as all loans need to be factored into your debt-to-income ratio.

Perito has seen borrowers tell the lender their parents are gifting the money, but it's actually a loan. "They expect their kids to pay it back eventually," she says. "That can cause a problem because the lender has to take that into consideration for the debt-to-income ratio."

The moral of this story: Be honest with your lender about where you're receiving all funds for your down payment — they'll likely find out anyway.

What Else Should You Know About Down Payment Gifts?

As previously mentioned, there's a difference between receiving a down payment gift and a down payment loan. Buyers need to be clear with their mortgage lenders and confirm that the money received was gifted. A sudden infusion of cash without a traceable source will leave lenders suspicious and, perhaps, wary of completing the loan deal on their end.

Plus, you should talk with your lender to make sure are reporting the gift properly to the IRS.

How much can be gifted for a down payment?

As of 2018, parents can contribute a collective $30,000 per child to help with a down payment — anything after that would incur the gift tax. Other family members have a $15,000 lending limit before they, too, have to pay taxes.

In many cases, there's no limit on the amount of gift money that can go into a down payment, as long as the buyer is purchasing a primary residence. However, if someone uses a down payment gift to buy a second home or investment property, they have to pay at least 5% of the down payment. The rest can be a gift.

What is seasoned money?

If possible, it's a good idea to ensure gift money is seasoned when it comes time to funnel it into a down payment — this avoids the gift documentation needed too. Lenders want proof that funds have been in the buyer's account for a substantial amount of time to show that the buyer hasn't just gathered a bunch of cash on a short-term basis.

Seasoned funds should sit in the buyer's bank account for, ideally, two months before the buying process. So, if you received a $10,000 gift from your Aunt Mary three months ago to help you buy a house, then the bank probably won't ask about it — this is seasoned money.

Tax Implications of a Down Payment Gift

As previously mentioned, family members have to pay a gift tax for anything over their limit of $15,000, or a collective $30,000 from parents who file taxes jointly. The person receiving the money doesn't have to pay taxes.

If the donor wants to give more than $15,000, they can either pay taxes or claim the money as part of their $5.6 million lifetime exemption for gift taxes. However, this decision shouldn't be taken lightly, especially if the donor hopes to pass on a hefty estate to their heirs later on. The $5.6 million exemption applies to taxes on these funds, so using up the value now could force family members to pay tax on whatever they inherit.

Buying a Home is More Than a Down Payment

Ultimately, the cost of the down payment is only one expense to consider in the home-buying process. Homebuyers need to pay for closing costs, which include expenses like an appraisal, credit report, and underwriting fees.

"Many people these days have a hard time coming up with $1,000 to become a homeowner," Perito says. "I always ask them where they'll be getting money for the inspection, moving costs, and other expenses. I suggest to all my buyers that they have at least $4,000 in the bank before they buy a house."

The Do's and Don'ts of a Down Payment Gift

| Do… | Don't… |

| Get a signed statement from the gift giver | Tell the lender the funds are a gift when it's a loan |

| Remind gift giver to keep a paper trail | Change or add money without explanation |

| Get the money in advance and know how seasoned money works | Assume all loan types allow down payment gifts |

| Understand the monetary limit of gift funds for tax purposes | Neglect the mortgage because you have no money in the game |

Down payment gifts can make it easier for homebuyers to afford a home

If you're in the market for a new home and want a little help, don't hesitate — just make sure you follow the above steps to ensure you accept such a gift in the proper manner. A gift can put homeownership in reach for plenty of aspiring homeowners.

When you speak with your lender about which loan program is best for you, be sure to let them know upfront that you plan on using gift funds for the down payment. Some loan programs have strict guidelines about how much gift money you can use for a down payment and who can gift you the money.

Check your eligibility to use gift money for a down payment. (Nov 7th, 2021)

Can I Give My Son Money To Buy A House

Source: https://mymortgageinsider.com/dos-and-donts-of-getting-your-down-payment-as-a-gift/

Posted by: rodriguesaforeg.blogspot.com

0 Response to "Can I Give My Son Money To Buy A House"

Post a Comment